Fdic Edie

Fdic's edie Estimate your insurance coverage on personal bank accounts. EDIE lets consumers and bankers know, on a per-bank basis, how the insurance rules and limits apply to a depositor's specific group of deposit accounts. The FDIC’s Electronic Deposit Insurance Estimator (EDIE) lets consumers know, on a per-bank basis, how the insurance rules and limits apply to a depositor's specific group of deposit accounts—what's insured and what portion (if any) exceeds coverage limits at that bank. The FDIC's Electronic Deposit Insurance Estimator (EDIE) is a quick and easy way to find out if your deposits are all covered under FDIC insurance. EDIE calculates the insurance coverage for Personal Accounts—deposits held by people in single accounts, joint accounts, POD/ITF accounts, living trust account, irrevocable trust accounts,. The FDIC Electronic Deposit Insurance Estimator (EDIE) EDIE lets consumers and bankers know, on a per-bank basis, how the insurance rules and limits apply to a depositor’s specific group of deposit accounts – what’s insured and what portion (if any) exceeds coverage limits at that bank. EDIE also allows the user to print the report for.

FDIC Insurance

American Bank is a member of the Federal Deposit Insurance Corporation (FDIC). American Bank’s FDIC Certificate Number is 34422.

We’re here to help you by answering some of your frequently asked questions about FDIC insurance and how much coverage is available for your accounts at American Bank.

Q: What is the Federal Deposit Insurance Corporation (FDIC)?

A: The Federal Deposit Insurance Corporation (FDIC) is a federal agency organized in 1933 that insures depositors’ account up to the insured amount at most commercial banks and savings associations. Since its inception, the FDIC has responded to thousands of bank failures. All insured deposits of failed banks and thrifts have been protected by the FDIC.

Q: What is insured by the FDIC?

A: Types of American Bank products that the FDIC insures include:

- Checking Accounts

- Money Market Accounts

- Savings Accounts

- Certificates of Deposit (CDs)

- Deposit Accounts owned by certain types of Trusts

Q: What amount of insurance coverage do I have for my accounts?

A: Effective July 21, 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act permanently raised the current standard maximum deposit insurance amount to $250,000. The FDIC insurance coverage limit applies per depositor, per insured depository institution for each account ownership category.

Basic FDIC Deposit Insurance Coverage Limits**

Edie Fdic Coverage

| Single Accounts (owned by one person) | $250,000 per owner |

| Joint Accounts (two or more persons) | $250,000 per co-owner |

| IRAs and certain other retirement accounts | $250,000 per owner (not changed) |

| Revocable Trust Accounts | $250,000 per owner per beneficiary (subject to specific limitations and requirements) |

| Corporation, Partnership and Unincorporated Association Accounts | $250,000 per corporation, partnership or unincorporated association |

| Irrevocable Trust Accounts | $250,000 for the non-contingent, ascertainable interest of each beneficiary |

| Employee Benefit Plan Accounts | $250,000 for the non-contingent, ascertainable interest of each plan participant |

| Government Accounts | $250,000 per official custodian |

* These deposit insurance coverage limits refer to the total of all deposits that an accountholder (or accountholders) has at each FDIC-insured bank. The listing above shows only the most common ownership categories that apply to individual and family deposits, and assumes that all FDIC requirements are met. The increased coverage limit became permanent effective July 21, 2010.

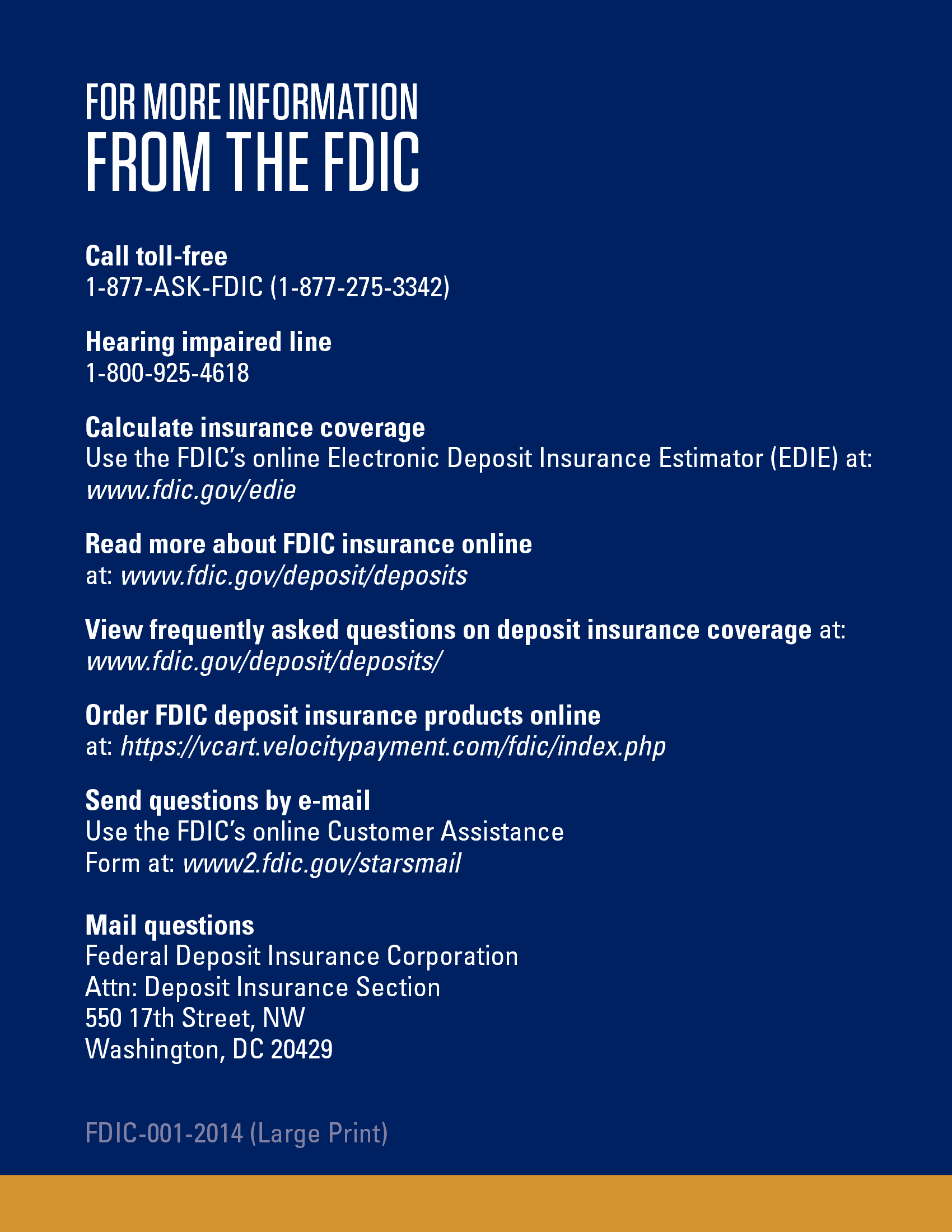

Q: Where can I find additional information from the FDIC?

Fdic Coverage Calculator

A: You can learn more about FDIC insurance at: www.fdic.gov/deposit

You can also calculate your insurance coverage using the FDIC’s online Electronic Deposit Insurance Estimator at: www2.fdic.gov/edie

Fdic

For a detailed description of ownership categories, request a copy of “Your Insured Deposits: FDIC’s Guide to Deposit Insurance Coverage” by calling toll free: 877.275.3342.

Q: What if I still have questions?

A: You can call FDIC toll-free at 877.ASK.FDIC (1.877.275.3342) from 8:00 am – 8:00 pm ET, Monday through Friday or send your questions by e-mail using the FDIC’s online Customer Assistance Form at: www2.fdic.gov/starsmail. You can also mail your questions to:

Fdic Insurance Calculator

Federal Deposit Insurance Corporation

Attn: Deposit Insurance Outreach

550 17th Street, NW

Washington, DC 20429-9990

Our Customer Service team is also available by phone at 888.366.6622 or by clicking here to send us a secure email to answer your questions and provide additional information. It will be our pleasure to assist you.