Absa Fixed Deposit Rates

Blog Lastest

We are providing high skilled and quality web based and open sourced system development service at our Vietnamese offshore centre.

At the same centre, there are also various services for software/system maintenance, software product development and web

02.09.2020 HOLIDAY NOTIFICATION

On the occasion of the 75th anniversary of the successful August Revolution and the National Day of the Socialist Republic of Vietnam on September 2, 1945 – September 2, 2020, gumi Vietnam wish that everyone have good health and be happy with family. Besides, gumi Viet Nam would like to announce the company’s holiday schedule...

First time make game by LibGDX

Hello this is first time i try to make a small game by Libgdx, before i make this game i plan/design contruct for this game, but when i research and write by Libgdx, i think everything don’t like i throught. LibGDX don’t have any layout, all object, image dont appear. I just see text..text…and text,...

- The rate of 7.75% is 0% higher than the average 7.75%. Also it is the highest rate for this term period 7.75 Updated Aug, 2019 on ABSA Bank's secure website.

- You need a minimum deposit of Rs100,000. The minimum deposit in foreign currency is USD5,000 or the equivalent. This account can be used to secure a loan or other banking facility. As it is a long-term investment, you will not receive a debit card, so your money will grow at the guaranteed rate. Please check the latest applicable interest rate.

- Sitemap Absa Bank Ghana Limited. Registered in Ghana (registered no. Registered Office: Absa House, High Street, Accra, Ghana. Absa Bank Ghana Limited is regulated by the Bank of.

If yes, in this post you will learn more about the ABSA Dynamic Fixed Deposit and Interest Rates. ABSA offers you the opportunity to have a Dynamic fixed deposit account where you can earn monthly deposit interest based on the amount fixed, term duration as well as interest rates.

BoomBoomBalloon

Today, the web gaming applications become increasingly popular and diverse … these apps are created from many different programming languages . Today I would like to introduce a game demo written by three language are: html, css and javascript language and I already had one game name is BoomBoomBalloon at: BoomBoomBalloon demo you can try...

This is a complete list of the best savings accounts in South Africa 2021.

As Grant Cardone would usually say, store 40% of your income every month, if you want to enjoy financial freedom in the future.

Saving money is never easy with the cost of living in South Africa.

How would you find the best savings account that offers access to money when you need it and the best annual interest rate?

We'll list the top savings account that offers great benefits in South Africa.

Let's get started.

Savings Account Benefits

Opening a savings account with a bank must give you peace of mind knowing your money is kept safe and will grow in investments over time.

Secondly, what determines a great savings account would be the annual interest rate and easy access to cash.

Look:

If you don't open a savings account, you could misuse the money or risk losing your money.

So, before you think of opening a savings account, it would be wise to shop around and do some good research. This will help you find savings account that best suit your financial plans.

Whichever savings account you're going to go with must pay interest on money in your account. Also, the bank will contribute to your account every month.

The rates depend on the minimum deposits and of course, the bank policies. Some banks pay higher savings account rates due to competition.

Now, here's the best savings account you can choose from in South Africa.

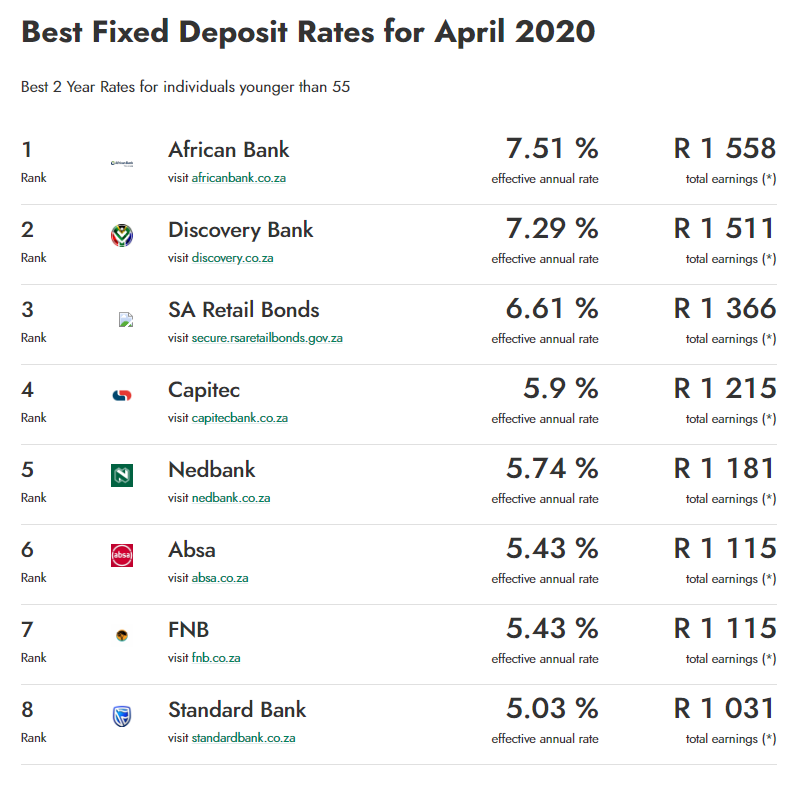

Which Bank Has The Best Fixed Deposit Rate

The Best Savings Account in South Africa

South African banks offer various types of savings account, e.g. fixed and tax-free savings accounts.

These accounts were created to assist the working class in South Africa to secure their hard-earned money.

1. FNB Savings Account

FNB helps people save and invest money for unforeseen emergencies and expenses.

The account offers a maximum of 6.05% interest rate per year.

You'll have immediate access to your savings at no fee.

2. Capitec Bank Save

Capitec Bank is popularly known for its offering savings account to students, low-income, and the middle working class.

They offer four different types of savings account:

Transaction and savings - A minimum of R25 earning a minimum of 4.75% interest per year.

A flexible savings plan - You get to choose the amount you'd like to save and the frequency of your deposit. Earn a minimum of 4.75% interest per year with access to the savings anytime.

A fixed-term savings plan - Invest a single amount from R10 000, choose the terms between 6 - 60 months, and earn up to 8.55% interest.

Tax-free savings account - Invest money in your Capitec savings tax-free account and earn interest from R1. Your total savings will not be taxed during the withdrawal unless you've saved over R500 000.

3. African Bank Fixed Deposits

With a minimum deposit of R500, you can earn a maximum interest rate of 10.75% annual payout.

Depending on the terms you choose, African bank offers the best rates in South Africa.

Use the African Bank savings calculator to guide your investments.

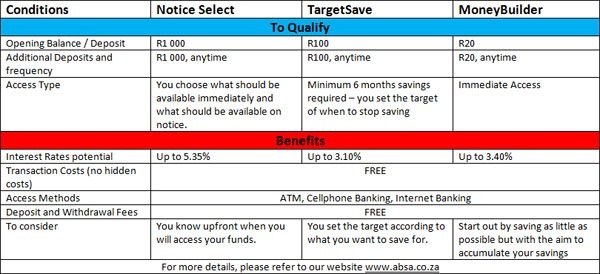

4. Absa Tax-Free Savings Account

Invest from R1 000 into the Absa account without paying tax on the interest earned.

You'll have access to the money whenever you need it. There are no monthly fees, so you can add funds into your savings account whenever you want.

You can only save up to R33 000 per year according to tax laws to avoid penalties from SARS.

Absa Fixed Deposit Interest Rates

5. Bidvest Bank Savings Account

Depending on the duration of the investment, you put in a minimum of R10 000 into the Bidvest savings account. Earn up to 7.88% when you invest for 12 months.

It's a fixed deposit account which means you invest once and benefit from the interest charge per month.

They also offer other savings account that requires a minimum of R1 000 but a low-interest rate of 3.2%.

How to open a savings account

All you need to open a savings bank account in South Africa is your SA ID book or valid passport and proof of residence.

Some banks require a minimum deposit into your savings account, so you would need to ask customer service for more details.

Set up a goal and select how long you would like to keep your money in the savings account.

You can open the account online or in-person at the bank. You would need to submit the above-mentioned document in both application methods.

Once your account is active, you can start your saving journey and enjoying the benefits.

Spending your savings

You had a big plan with the money you kept in the savings account. Spend the money however you feel fit - the choice if completely yours.

Absa Fixed Deposit Rates

- Maybe you were saving for a major purchase such as a car you love so much.

- You saved money for vacations with the beloved family.

- Perhaps, it's just an emergency savings account, you know best.